Following a challenging period in 2022, Merchant Bank of Sri Lanka & Finance Plc (MBSL), a subsidiary of Bank of Ceylon, has demonstrated remarkable resilience…

Read More...

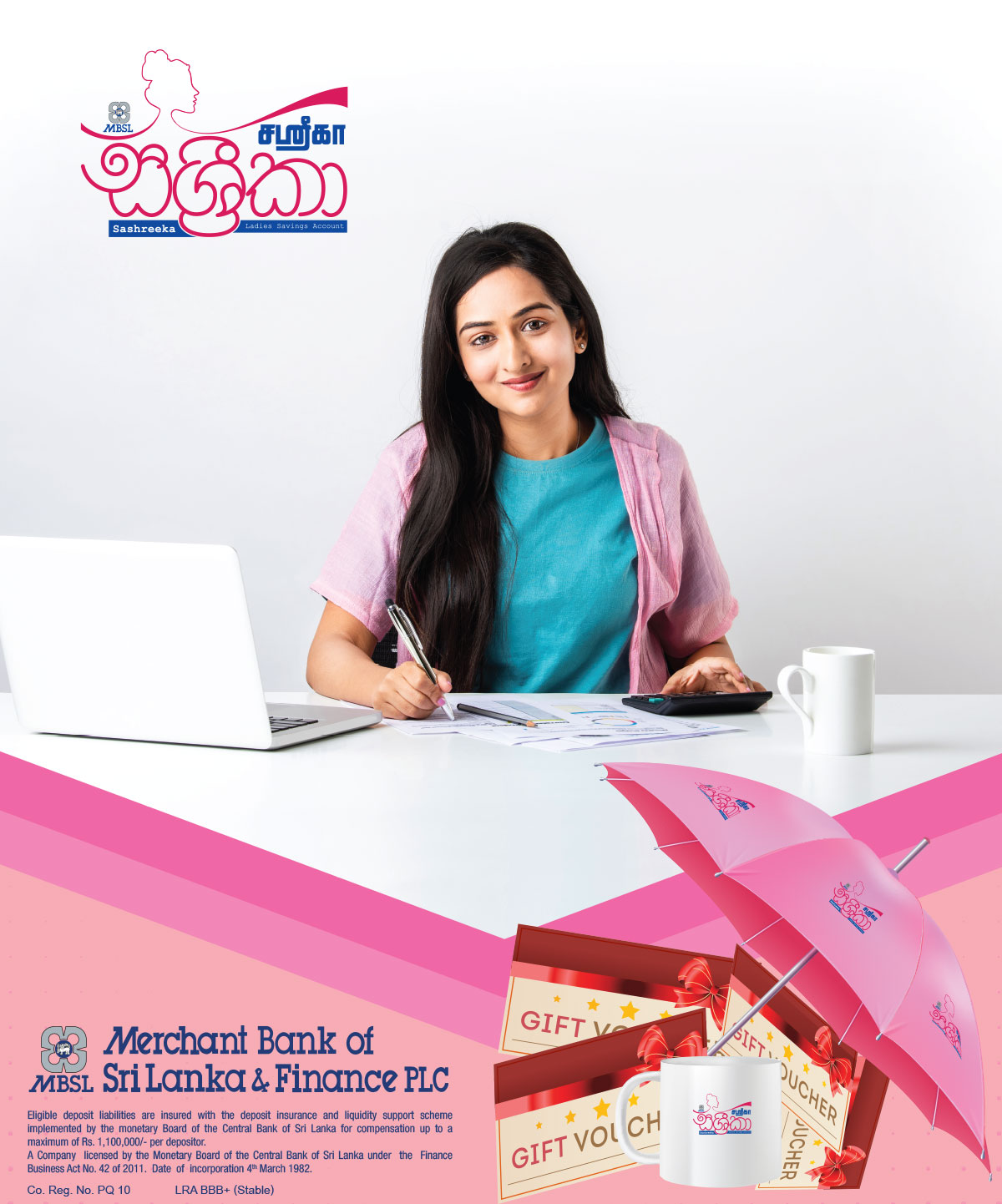

In our contemporary world, the spotlight on financial stability has never been brighter. Saving money is no longer merely a wise decision; it's a transformative…

Read More...

MBSL Welfare society never fails to bring something even more exciting to the table each year ..and this year, the fabulous MBSL Dinner Dance 2023…

Read More...

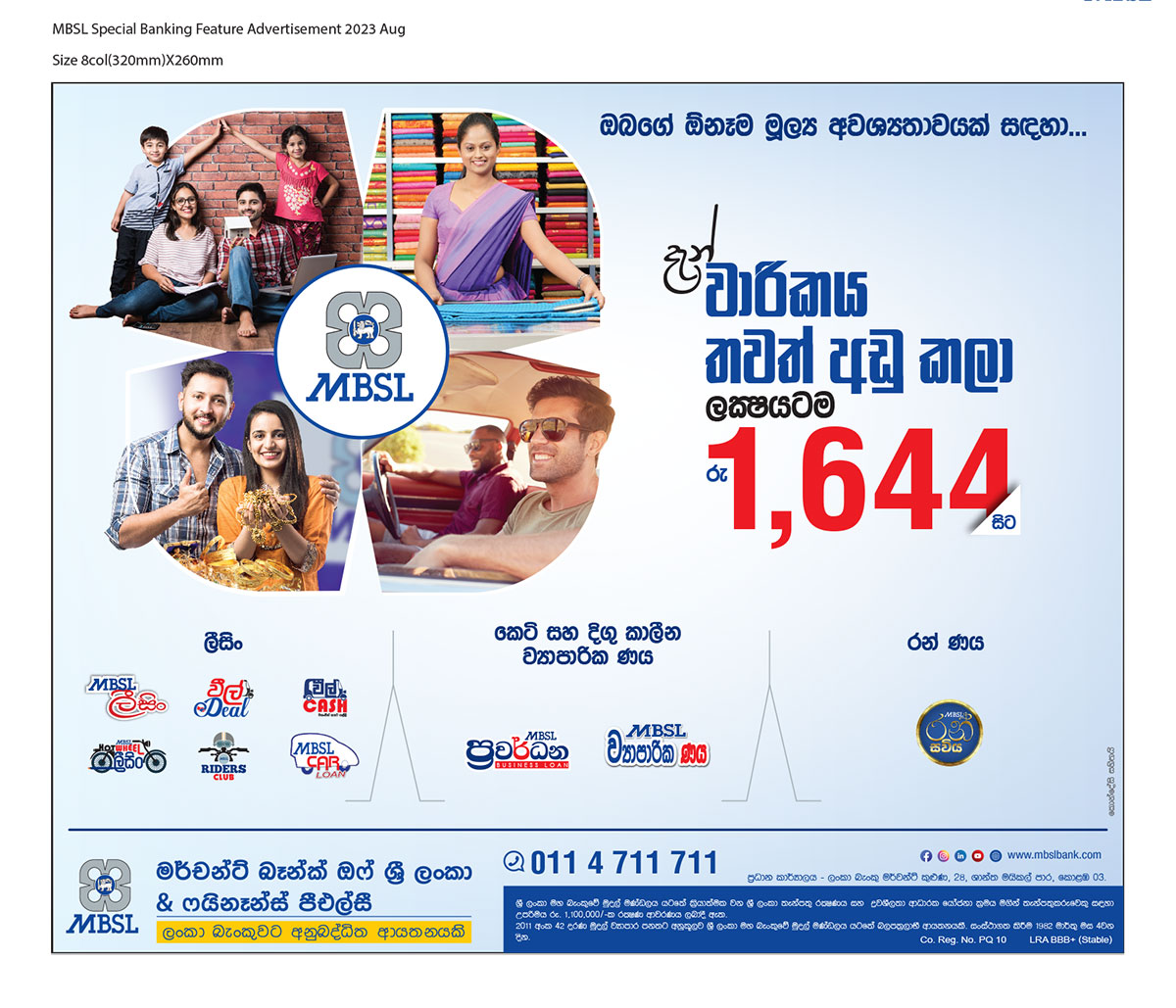

ශ්රී ලංකා මූල්ය වෙළෙඳපොළ තුළ වසර 41 ක අඛණ්ඩ අභිමානවත්ඉ තිහාසයක් හිමි MBSL (Merchant Bank of Sri Lanka & Finance PLC) ආයතනය වර්ෂ 1982 දී…

Read More...

Dialog Enterprise, the ICT solutions arm of Dialog Axiata PLC, helped enable the digital transformation initiative of (MBSL) by successfully completing the deployment of its…

Read More...

Independent/Non-Executive Director Anura Perera has been appointed as the new Chairman of Merchant Bank of Sri Lanka & Finance PLC (MBSL), a subsidiary of Bank…

Read More...