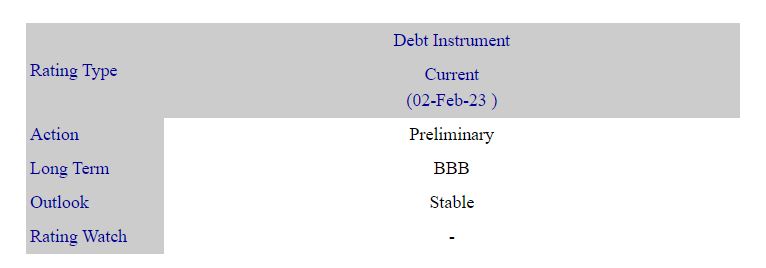

LRA Assigns Preliminary Instrument Rating to Merchant Bank of Sri Lanka & Finance PLC – LKR 01bn Unsecured Subordinated Redeemable Debentures (2) – TBI

Home > News & Events

The rating of the debenture highlights the unsecured subordinated structure, where the debenture will rank after all the claims of the secured and unsecured creditors and preferential claims under any statutes governing the Company, but in priority over the claims of shareholders. Consequently, the debt instrument is rated one notch below the entity rating. On the entity level, the rating takes comfort from Bank of Ceylon (BOC), which has been provided in written form. The rating reflects the competence of BOC as the largest shareholder of Merchant Bank of Sri Lanka & Finance PLC (MBSL or the Company). As a fully state-owned bank and one of the systematically important banks of Sri Lanka, BOC brings stability to MBSL. Its performance suffered in CY22 due to the dire economic condition in the country and incurred a loss of LKR 421mn as of 9MCY22. The ratings reflect the small relative position the Company holds and its ability to improve its performance in the long run. The Company has formulated a capital augmentation plan (CAP) with the consent of BOC as it does not comply with the Tier II capital requirement of the regulator. MBSL currently has regulatory restrictions imposed due to non-compliance. As per the CAP, MBSL targets to become capital compliant by March 2023. The Capital Adequacy Ratio as of 9MCY22 is recorded at ~11.2%. The Company records a gross Non-Performing Loan ratio of ~15.9% as of CY21, which increased to ~18.5% by 9MCY22.

The rating is dependent on the Company’s ability to improve its Tier II capital to adhere to the statutory requirements. Improving its credit risk in the current macro-economic conditions would be vital for the improvement of its performance. The rating will rely on the continuous support from BOC and the Company’s proficiency in building a diversified portfolio while preserving its asset quality.

About the Entity

Merchant Bank of Sri Lanka & Finance PLC (“MBSL” or “the Company”) is a registered Finance Leasing Company under the provisions of the Finance Leasing Act No. 56 of 2000 and a Finance Company licensed by the Monetary Board of Central Bank of Sri Lanka under the Finance Business Act No. 42 of 2011. The largest share of ~76.6% is owned by the Bank of Ceylon (BOC) directly while the group owns ~86.8% of MBSL. The Board of Directors has nine members, out of which six are Non-Independent and represent the sponsor.

About the Instrument

Merchant Bank of Sri Lanka & Finance PLC (“MBSL” or “the Company”) plans to issue an LKR 1bn unsecured subordinated redeemable five-year debenture. The planned issue consists of four types of debentures. Type A and B offers a fixed rate paid annually and bi-annually respectively. Type C provides a quarterly payment with a floating rate of 364 days weighted average treasury bill rate + 375 basis points, with a cap. Type D is a zero-coupon debenture that is redeemable at the maturity value, which includes interest. The objective of the issue is to increase the medium-term fund base to match the medium to long-term lending portfolio and to enhance the total capital base. The debenture is not underwritten and the principal and the interest are not secured by a specific asset.

Link – http://165.22.107.238/wizlanka/storage/app/RR_80_50_02-Feb-23.pdf